Two-thirds (64%) of consumers say the world felt more unstable over the past year, a recent Datassential survey found, setting the backdrop for how both operators and consumers are approaching foodservice decisions in 2026.

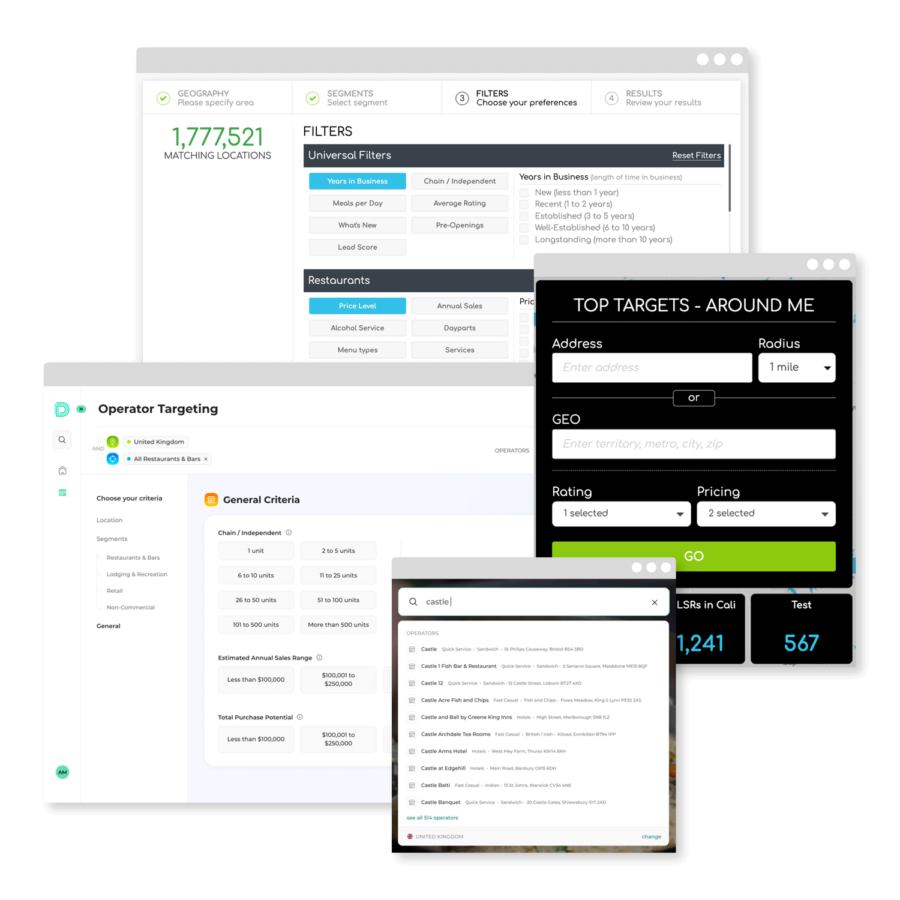

According to Datassential’s latest sales intelligence data — spanning operator performance, consumer behavior, menu activity, and restaurant unit counts — the market is sending mixed but highly actionable signals. Growth hasn’t disappeared. Pressure hasn’t eased. Instead, the industry is recalibrating in real time.

In these uncertain times, it’s critical to have a partner that cuts through the noise.

Here are five things foodservice professionals need to know about the state of the industry right now, based on what Datassential’s proprietary data and surveys are actually showing. And if you’d like to explore the insights shared by Datassential experts, watch our 2025 By the Numbers webinar on demand.

EN | English UK

EN | English UK DE | Deutsch

DE | Deutsch FR | Français

FR | Français IT | Italiano

IT | Italiano SP | Español

SP | Español