- Solutions

-

-

-

Solutions

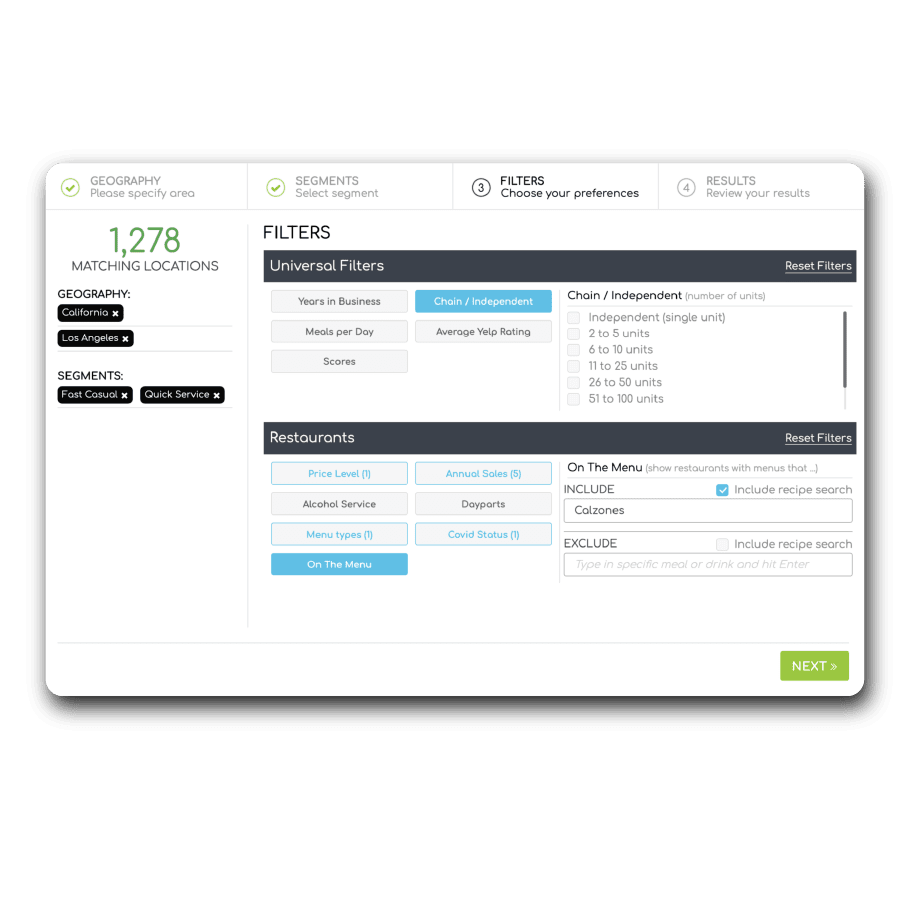

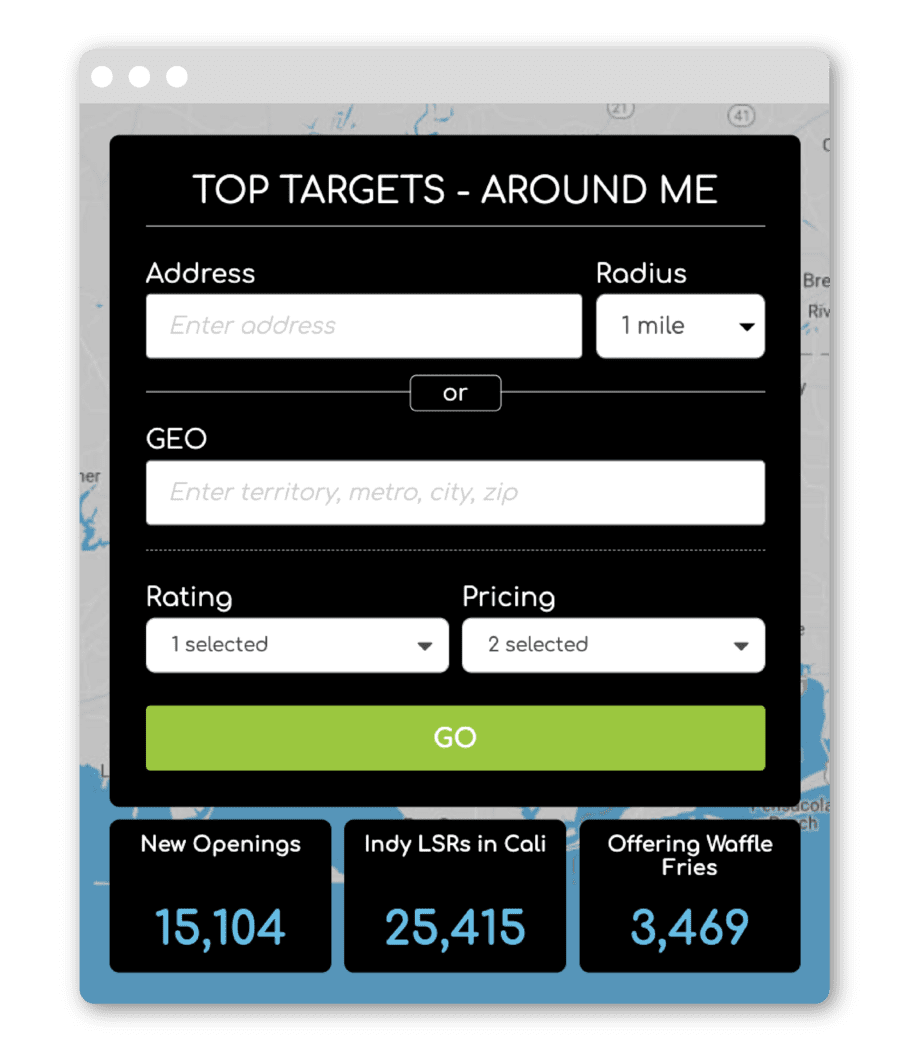

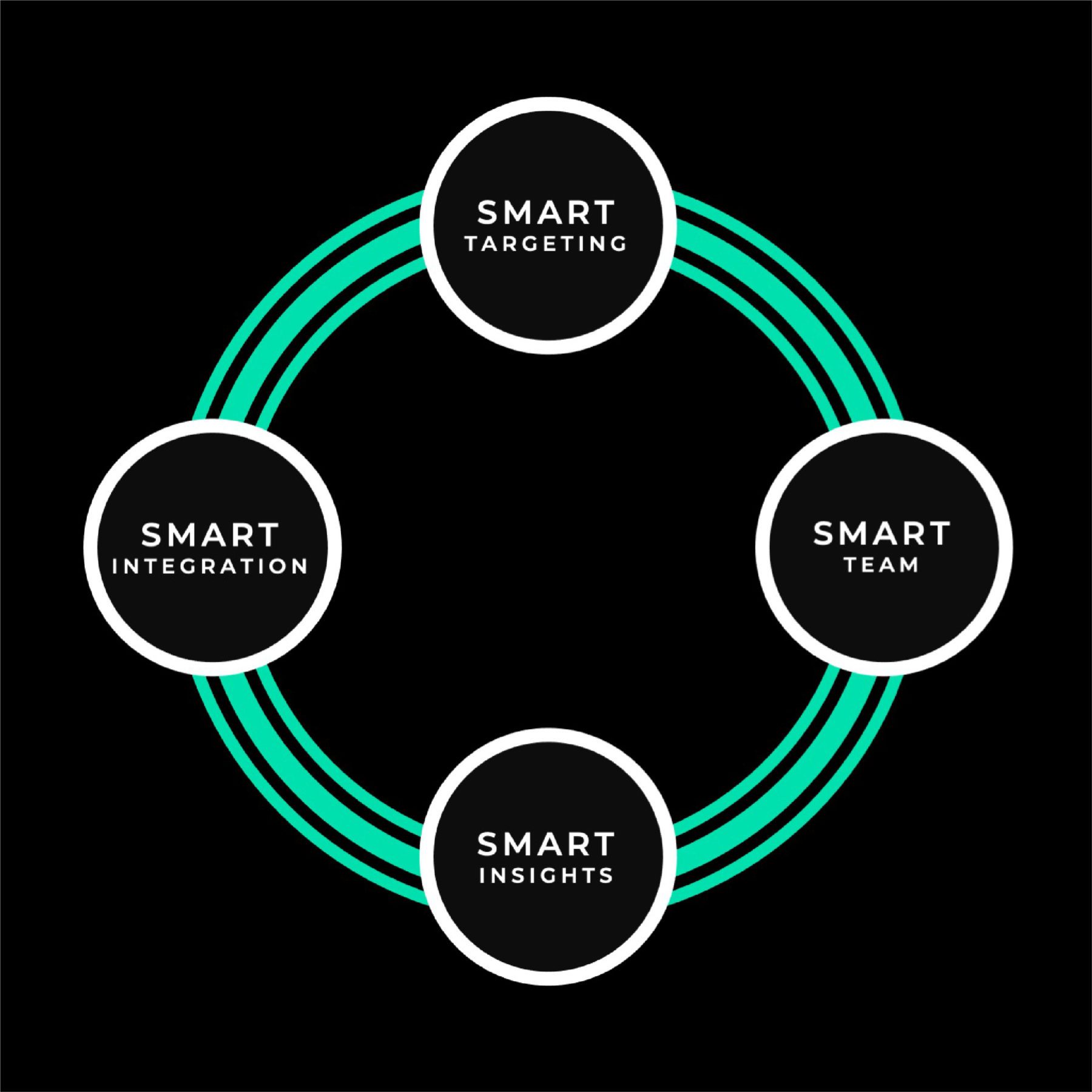

Datassential is revolutionizing the way food and beverage companies plan for the future. Our market-leading solutions, from AI-powered innovation tools and predictive analytics to unmatched market intelligence and proprietary data, are trusted by the top food and beverage companies. We empower foodservice leaders to make simply smarter decisions.

-

-

-

By Industry Role

- Food Manufacturers

- Distributors & Suppliers

- Operators

- Business Services

-

-

-

- Resources

-

-

-

Resources

We’re here to help you and your team confidently navigate each new moment. Explore our free industry-best resources, including reports with expert insights on food and beverage trends and COVID-19 impact, our monthly trends webinar, and more.

-

-

-

- Company

-

-

-

Company

Datassential transforms data into craveable insights that are easily accessible, digestible, and inspirational. Learn more about the team and why we are so passionate about empowering the food and beverage industry.

-

-

-

- Request a Demo