When it comes to beverages, consumers look to many of the same traits as they do for food: healthfulness, premium attributes like organic, and the ability to customize. As the bar for beverages climbs higher, the food menu can serve as a source of inspiration. Some trending food ingredients are also now being used in beverages, including turmeric or cayenne in juice, cucumber or tamarind in soda, and avocado in milkshakes.

It’s worth noting that many non-alcoholic beverage trends are established at retail before coming to foodservice, unlike food trends, which typically start in restaurants and then make their way to retail. For example, kombucha and enhanced waters were making waves at retail before restaurants.

For restaurants, retail beverages offer an opportunity to engage customers in a new way. Offering on-trend bottled beverages in a cooler can be a low-risk way to increase variety and impress foodie customers—75% of operators now have reach-in beverage coolers, and 65% of those operators have customer-facing coolers, according to our Non-Alcoholic Beverage Keynote Report. Additionally, 43% of operators say their beverage sales from reach-in coolers have increased in the past year.

Take a deep dive into 4 consumer-favorite beverages.

All about the bubbles

Most popular at lunch and dinner, carbonated soda (CSD) brands have recently undergone some refreshes to regain consumer interest (think Mist Twst and Fanta). Regional favorites (Squirt, Mellow Yellow) and international brands (San Pellegrino, Jarritos, Ramune), in particular, are seeing growth. In the past 4 years, San Pellegrino has grown 34% on menus. Further, three-quarters of consumers are willing to try new flavors of soda and one-quarter of soda drinkers are more likely to buy small-batch and craft varieties.

What’s steeping?

At-home hot tea consumption accounts for about 90% of hot tea drinking occasions. While convenience is important for consumers of hot tea, they primarily drink it alone and on-premise when ordering it away from home. With warmth, comfort, and taste all top motivators for hot tea consumption, operators could consider highlighting those attributes, particularly as we enter into a cooler season when a hot beverage might just hit the spot.

Iced tea is consumed at a similar rate to milk and juice, with one in four consumers drinking it daily. 60% of consumers note that when they did drink iced tea away from home, it was with food. Though black tea is the leading type of iced tea consumed, whether at home or away from home, many consumers said they actually aren’t sure what kind of tea they drink, making it important to provide clear labeling and highlight any health benefits associated with certain varieties on menus and packaging to make them more memorable.

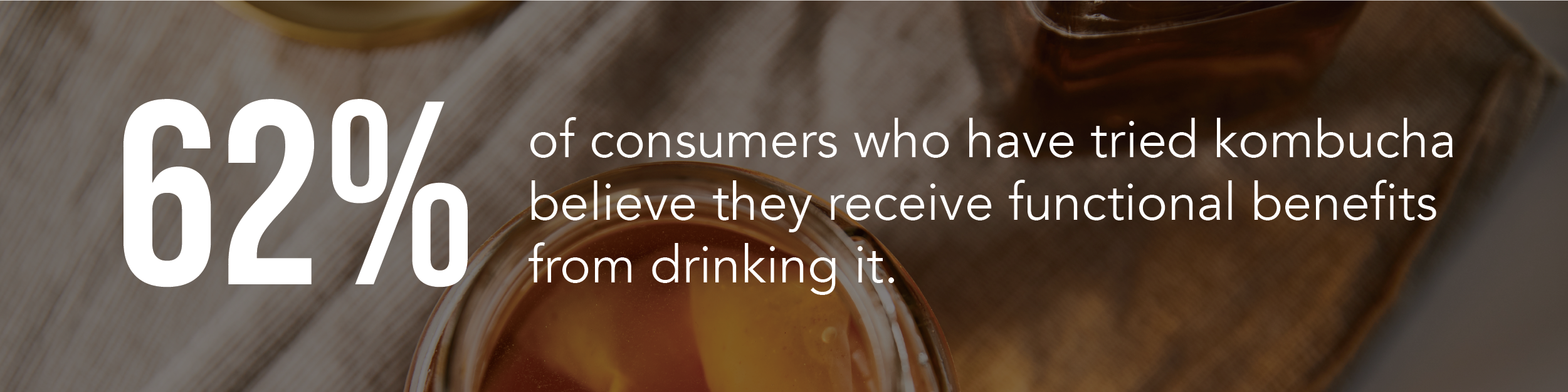

One of the fastest-growing types of tea is kombucha, which is fermented and often made using green or black tea and served cold. It’s one of the most frequently menued among functional beverages, seeing significant growth in just the past year alone—according to Datassential MenuTrends, it’s grown 71% on menus. The fast-casual segment, which has a high concentration of health-focused restaurants, has been especially enthusiastic about kombucha.

Non-alcoholic bottle service

Consumers are increasingly turning to items like bottled water (particularly enhanced or sparkling varieties) over traditional drinks such as CSDs, teas, juices, and milk. In fact, water (tap and bottled) accounts for one-third of beverage drinking occasions on any given day. Don’t try telling a water fanatic that they all taste the same. Brand preference is the top driver of retail sales for 60% of bottled water buyers.

Drink your fruits and veggies

Juice is a daily drink for about one-third of consumers, and virtually all trending juice flavors are vegetables or “superfoods.” Green juices, often containing both fruits and veggies like leafy greens, are experiencing major growth. For those that can’t stomach green juices, turmeric is increasing in popularity, as it boasts perceived anti-inflammatory effects that play into the functional foods trend that juice bars are embracing widely now.

Non-alcoholic beverages spike in popularity

Since beverages generally have a lower price point compared to food items, consumers may be more willing to take a chance on more innovative flavors. Consider incorporating on-trend options as limited-time offers (which could lead to permanent menu items). Opportunities for innovation are bubbling up for CSDs, especially outside the home where they are losing traction in a more competitive market.

To further stand out from the competition and increase brand recognition, operators might consider bottling a signature drink customers could purchase and take home or consume on the go.