The onset of COVID in 2020 was difficult for all restaurants. Full-service restaurant business was hit hard, plunging almost 30%, while limited service restaurants (including fast-casual and quick service restaurants) slipped just a few points. The quick service business model – focused heavily on value and convenience – enjoyed a huge advantage during COVID, while fast casual was also well positioned to shift their operations off-premise – completely in some cases. It was during this time fast casual operators among the Top 500 chains overtook their casual and fine dining competitors.

And in the three years since the onset of COVID, fast casual sales have surged while casual and fine dining sales posted moderate gains that simply returned sales back to 2019 levels by the time the industry was starting to recover last year.

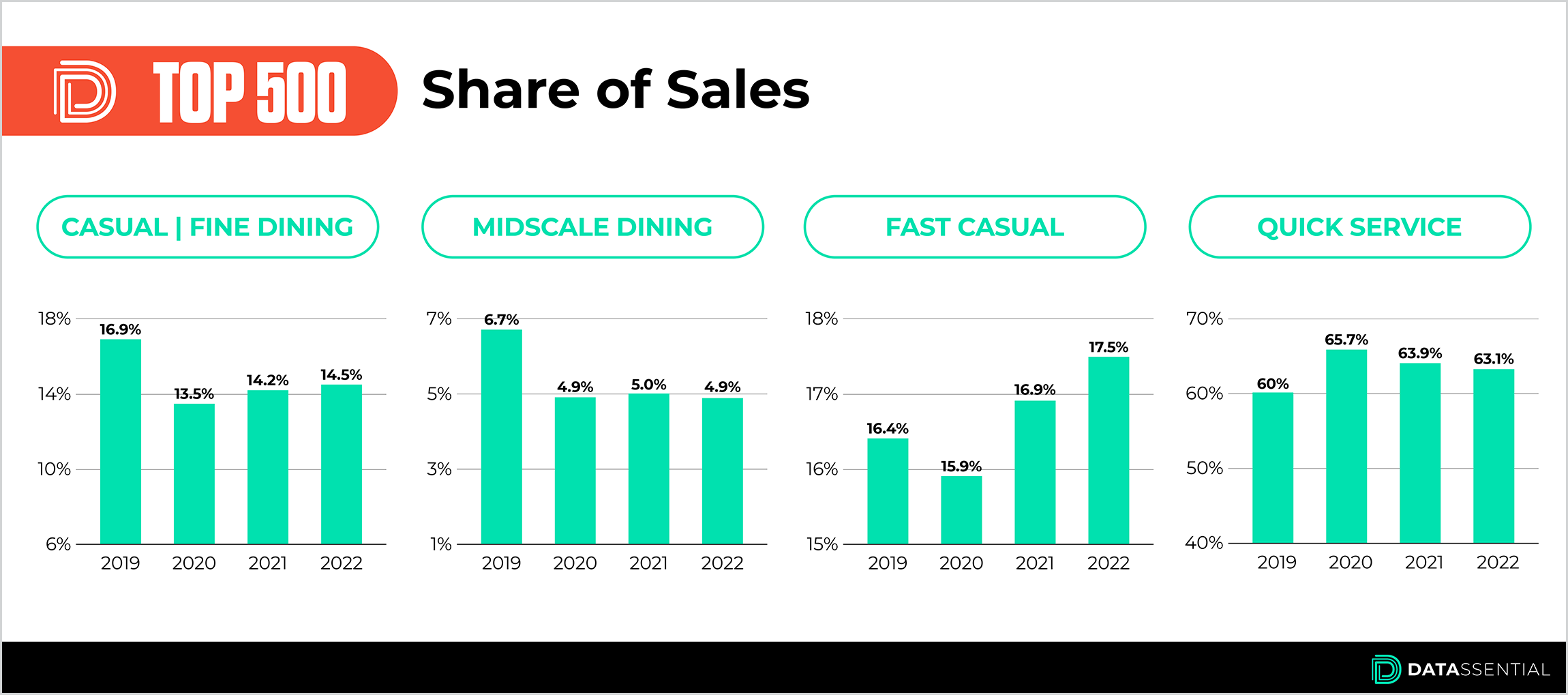

The fast casual segment’s share of the Top 500 grew from 16.4% in 2019 to 17.5% in 2022. By contrast, casual and fine dining’s share fell from 16.9% to 14.5% in the same timeframe.

Strong sales growth at fast casual restaurants has been driven by healthy average unit volume (AUV) gains and moderate increases in unit expansion.

The Fast Casual Flipside

While the fast casual segment has been the big winner since 2019, all fast casual restaurants have not fared equally well. While there are over 100 fast casual chains in Datassential’s Top 500, only 41 fast casual concepts outpaced Top 500 sales as a whole.

Among those that outpaced top 500 sales are many of the more established fast casual brands. These bigger brands are responsible for driving fast casual sales growth. they include:

| Tropical Smoothie |

| Chipotle |

| Wingstop |

| McAlister’s |

| Zaxby |

| Starbucks |

As we evaluate the trends among the Top 500, we’re able to see what’s working for the biggest- and fastest-growing concepts in our industry and in the process get a sense for where the industry is heading.

Fast casual’s success both during and after COVID speaks to how they’ve become a favored destination for consumers – and how we’re likely to see much activity and future evolution and growth in the fast casual arena.

_____________________________________________________________

Written by Dave Jenkins, Chief Business Officer at Datassential.

These insights are derived from Datassential’s annual Top 500 Report. For access to a preview of the report’s highlights, click here. The full report is available only to subscribers. If you would like to learn more about Datassential’s suite of food and beverage intelligence solutions, reach out to us here.

For media or press inquiries, email media@datassential.com.