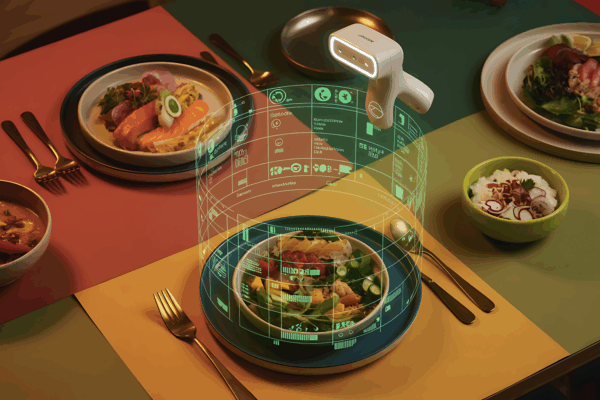

Datassential’s 2026 Trends Report is out! While you may already be familiar with this year’s “New Classics” like ube, MSG, and hot honey, forward-thinking operators and product developers need to look even further ahead.

Datassential has identified 10 emerging foods, flavors, and beverages poised to gain traction in the coming years. These ingredients represent the next wave of culinary innovation — rooted in cultural authenticity, ancient traditions, and bold regional flavors that are just beginning to capture consumer imagination.

Here’s a look at the 10 flavors to know for 2026 and beyond, with key data on consumer interest and trial from our Datassential One platform.

EN | English UK

EN | English UK DE | Deutsch

DE | Deutsch FR | Français

FR | Français IT | Italiano

IT | Italiano SP | Español

SP | Español